Why Choose Us

Affordable Rates & Professional Service

• Our rates are clear and transparent.

• You can estimate prices on our website.

• We deliver prompt and reliable service.

• Experienced and friendly.

Thorough Customer Safety & Customer Information Security

• We prioritize customer safety and security.

• Meet online or face- to- face.

• All information is transmitted through

a secure server.

• Customer data is stored on cloud servers.

IRS Enrolled Agent & Experienced Tax Professional

• Experience in one of the largest US tax

and accounting companies.

• IRS Enrolled Agent.

• Providing professional services in

accordance with the latest tax laws.

what we do

Face-to-face or Online Services

Are you worried about close contact with strangers and office visits in the era of COVID-19? Try our remote online service. We can provide exactly the same quality of service remotely as we do face-to-face.

Fast and Secure E-file Service

DWY Tax & Accounting Services is an authorized IRS e-file provider. In addition, we maintain a secure server; all data uploaded by customers are encrypted and transmitted safely.

Individual and Business Taxes

Send all relevant data in the most convenient way for you, whether that is text message, email, or file upload. An IRS enrolled agent will thoroughly review and report all taxes, including federal, state and local taxes.

Payroll and Bookkeeping

Our experts meticulously and intensively manage your accounts, making a thorough check that tax data are not omitted. We will reduce your taxes with fine-tuned expense processing, tax deductions and tax credits.

Incorporating a Business

Whether it’s a corporation, S corporation, LLC, or a non-profit organization, through consultation we will find the most advantageous business type for you and establish it at a low cost.

Tax Planning and Consulting

Our tax experts provide proactive tax planning and business consulting. By communicating with customers throughout the year, we’re able to deliver greater benefits and minimize problems.

estimated cost

treatments of childhood cancer and difficult-to-cure diseases.

-

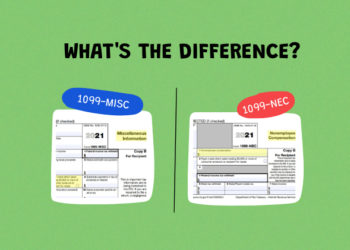

Form 1099-MISC vs. Form 1099 NEC

What is this highly valuable asset? Its own people. Says Morgan Fraud, the author of The Thinking Corporation, “Given that we are all capable of contributing new ideas, the question becomes how do you successfully generate, capture, process and implement ideas?”

September 15, 2021 -

Married Filing Jointly vs. Married Filing Separately

What is this highly valuable asset? Its own people. Says Morgan Fraud, the author of The Thinking Corporation, “Given that we are all capable of contributing new ideas, the question becomes how do you successfully generate, capture, process and implement ideas?”

September 15, 2021 -

When You Must File a Tax Return and When You Don't Have To

What is this highly valuable asset? Its own people. Says Morgan Fraud, the author of The Thinking Corporation, “Given that we are all capable of contributing new ideas, the question becomes how do you successfully generate, capture, process and implement ideas?”

September 14, 2021 -

The Website Renewal Has Been Completed.

What is this highly valuable asset? Its own people. Says Morgan Fraud, the author of The Thinking Corporation, “Given that we are all capable of contributing new ideas, the question becomes how do you successfully generate, capture, process and implement ideas?”

September 9, 2021

Please contact us with any questions or requests regarding tax returns, bookkeeping, payroll, incorporation and so on. Once we have received your enquiry, we will reply by email or phone.